Introduction

The explosion of Buy Now, Pay Later (BNPL) services has revolutionized how consumers shop and handle their money. These short-term installment programs enable consumers to break up purchases into smaller interest-free payments, making luxury products affordable. Though BNPL provides flexibility and ease of use, it also leads to overspending and financial peril. This blog delves into how BNPL is changing the face of consumer spending, its advantages and limitations, and everyday instances of how it affects them.

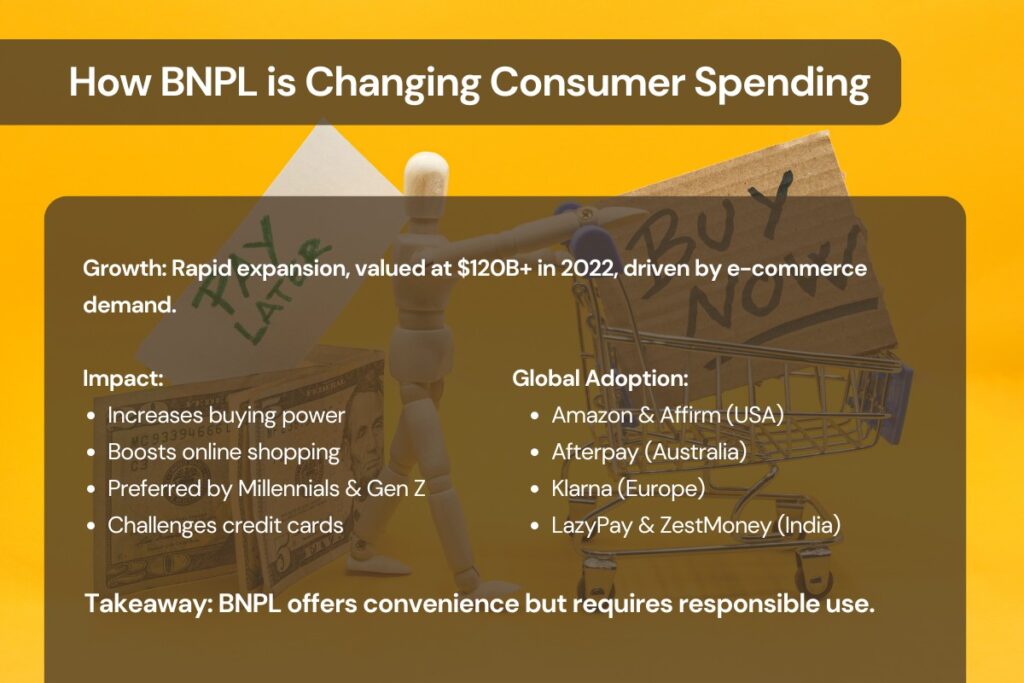

The Growth of BNPL Offerings

BNPL has advanced quickly on a global scale, led by companies like Klarna, Afterpay, and Affirm. In a report published by Grand View Research, the BNPL market was estimated at more than $120 billion in 2022 and is set to expand rapidly in the years to come. The growth of e-commerce and shifting consumer demands for convenient payment terms have been driving this expansion.

What Impact is BNPL Having on Consumer Spending Patterns?

- Increased Buying Power: BNPL allows consumers to purchase items they may not be able to afford directly. This has especially impacted big-ticket purchases such as electronics, apparel, and holidays.

- Transition to E-Commerce: Online shopping sites have incorporated BNPL payment options, motivating more consumers to make online purchases. Convenience with installment payments makes online shopping more inviting and convenient.

- Young Consumers Driving the Trend: Millennials and Gen Z are the key customers of BNPL offerings, opting for them over traditional credit cards because of their transparent fee structures and instant approvals.

- Credit Card Usage Impact: Many consumers are choosing BNPL over credit cards to stay away from high-interest rates and convoluted repayment terms. This trend is upending the credit industry and is forcing banks to introduce their own installment payment solutions.

Real-World Examples

- Amazon & Affirm Partnership (USA): Amazon has incorporated BNPL services via Affirm, enabling customers to pay for purchases in installments.

- Influence of Afterpay in Australia: Afterpay has transformed the Australian retail market, with numerous stores experiencing higher sales because of the presence of BNPL facilities.

- Klarna in Europe: Klarna has grown throughout Europe, working with retailers to offer flexible payment options and boost consumer purchasing power.

- LazyPay in India: BNPL solutions like ZestMoney and LazyPay have gained popularity in India, enabling consumers to purchase fashion items, electronics, and airline tickets without using a credit card. Online marketplaces such as Flipkart and Amazon India provide BNPL opportunities, making big-ticket purchases more accessible to Indian consumers.

The Pros and Cons of BNPL

Pros:

- Interest-Free Payments—In contrast with credit cards, the majority of BNPL platforms provide interest-free payments when settled on time.

- Convenience & Accessibility—User-friendly, immediate approvals, and a minimal application process are required.

- Increases Retail Sales—Makes consumers purchase more, thereby earning both buyers and sellers.

Cons:

- Enables Overspending—Readily available BNPL can translate into impulse purchasing as well as unwanted debt.

- Late Fees & Charges—Unsettled payments result in heavy fines, disrupting monetary stability.

- Impact on Credit Score—Certain BNPL providers report late payments to credit bureaus, which can damage credit scores.

Conclusion

BNPL is unquestionably transforming the way consumers spend, providing a convenient alternative to credit cards and driving retail sales. While convenient and accessible, consumers need to be careful not to overspend and pay their repayments responsibly. Governments and financial institutions are increasingly considering regulation to provide consumer protection and sound lending practices.

FAQ

1. Is BNPL superior to a credit card?

BNPL is an excellent choice for interest-free temporary transactions, but credit cards provide rewards and credit-building rewards. The selection varies based on personal spending patterns.

2. Does BNPL impact credit scores?

Some BNPL companies report missed payments to credit agencies, which can harm credit scores.

3. Do BNPL services include hidden fees?

Most BNPL services are up-front, but there can be penalties for delayed payments. Carefully read the terms before joining up.

4. Who should utilize BNPL?

BNPL suits disciplined buyers who can handle repayment without being late.

5. Will BNPL be regulated someday?

Most governments are exploring stronger regulations to uphold responsible lending and consumer safety.

BNPL is here to stay, and its influence on international consumer expenditure will keep changing. Its responsible use is the key to reaping its full benefits without falling into financial traps.

Leave a Reply